Everything about Synthetix, the Derivatives Liquidity Protocol

Jump to:

Synthetix is a DeFi mechanism for synthetic crypto assets. It was founded as a result of the 2018 bear market, paving the way for decentralised finance to take off as a significant industry in the cryptocurrency arena.

Before making a significant turn during the cryptocurrency market to become a platform for synthetic assets, Synthetix was a stablecoin project called Havven. Some of the DeFi landscape's widely accepted standard mechanisms have been invented by the Synthetix community.

What is Synthetix?

A synthetic asset protocol called Synthetix enables the issuance of synthetic assets on the Ethereum platform. A synthetic asset could be viewed as a particular type of derivative product. It provides a means for you to be exposed to an asset without having to actually own it.

Examples of synthetic assets or Synth include fiat currencies like the USD, commodities like silver and gold, and cryptocurrencies like BTC or ETH. Even inverse synths are available that mimic the inverse of the underlying asset, providing traders with a simple option to hedge existing holdings and yield farmed positions or gain short exposure. Using Synthetix, traders are supposed to be able to gain exposure to particular assets that don't exist on-chain. The DeFi index, which measures the price of a basket of several DeFi assets, is one of the indexes that can be created using Synthetix.

Synthetix Network Token (SNX)

Instead of being backed by an underlying asset, Synths are collateralized by mostly using SNX, the platform's native coin. Synthetix recently expanded the supported collateral to include ETH.

Each synthetic asset used by Synthetix is overcollateralized, which means that more value is pledged as security than the asset is worth. Users stake collateral (SNX) and mint a synthetic asset against it to produce synths. In essence, each Synth is a debt secured by the provided collateral.

How to Get Started With Synthetix?

Step 1: You can log in by connecting using Metamask or your hardware wallet. There is no lengthy log-in processes, registration, or KYC.

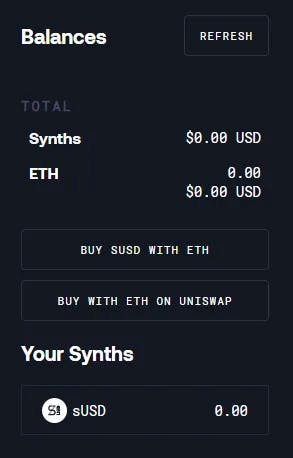

Step 2: Your available ETH and Synths will be shown on the left once you log in. You need to first have Synths and then some ETH to cover transaction costs in order to trade on the Synthetix Exchange.

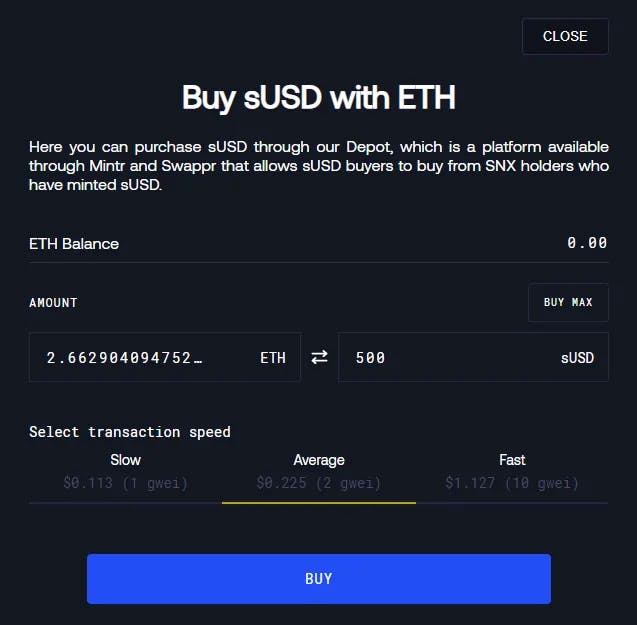

Step 3: You can purchase sUSD with ETH if you don't have any Synths. Choose how much ETH you want to sell for sUSD or how much sUSD you want to purchase with ETH.

You can trade any other synth with the synth you have obtained so far.

Competitors of Synthetix

Several other platforms on the Ethereum chain like Liquity and DyDx form some major competitors of Synthetix.

In comparison to Synthetix, Liquity is a decentralised borrowing system that enables you to obtain loans with 0% interest using Ether as collateral. DyDx, on the other hand, is one of the most powerful open trading platforms for crypto assets.

Conclusion

A synthetic asset protocol on Ethereum is called Synthetix. Synths allow consumers to follow the price of an underlying asset without really owning it. One of the first DeFi projects to implement a decentralised governance system using the SynthetixDAO is Synthetix. Although Synthetix is not the most intuitive project, as it is implemented on Optimism's rollup implementation, its acceptance may grow.

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.