How Does Flint Generate Returns

Jump to:

Brief

May 1st 2022 onwards, Flint has been generating yields through margin funding on centralised exchanges. Our in-house yield optimising system continuously scans for available yields (and volumes) on margin funding, across pre-selected crypto exchanges, and deploys capital from our central pool based on the best available rates.

Here’s the list of exchanges Flint scans before deploying capital:

- Crypto dot com

- FTX

- FTX US

- KuCoin

- CoinDCX

- Bitbns

- Huobi Global

What is margin funding in crypto?

Margin funding is the process of giving loans (called margin loans) to traders who participate in margin trading on exchanges.

To get a clearer picture of this, let’s understand margin trading first. When you trade with more capital than you have, you undertake margin trading. Imagine a hypothetical trader. Let’s name her Ellena. Now, Ellena has assets worth $1000 with her. She wants to take a long position on BTC as she is sure its price will go up by 20%. Taking a $1000 position would give her a profit of $200 if her hunch is correct. Ellena is very confident about her prediction and feels she should take an even bigger position, to make bigger profits.

She wants to take a position of $5000. The potential upside would then be $1000. And that’s more like it for Ellena. But she doesn’t have $5000. She only has $1000. So she participates in margin trading and takes a 5x leverage position (5x because she has $1000 herself, and $4000 from margin loans. The trade position is worth 5 times the capital she has). But who exactly is giving her that loan? It’s Flint. You can assume that Ellena has taken this loan from Flint at a cost of 12% p.a. And from the interest she pays Flint, we generate returns for you.

Margin funding is a common practice. The returns generated from these margin loans are passed on to you.

Security in margin lending

Margin loans we give out are secured. These loans are over-collateralized.

Let’s continue the example from above to understand how these loans are backed. Ellena has borrowed $4000 in this case. If things go as per her predictions, and BTC actually moves up by 20%, she will end up with a profit of $1000. Let’s assume she had borrowed it for 1 month which means she owes the exchange a total of $40. ($4000*12%*1/12). The exchange will keep back $40 from her profit of $1000 and let Ellena withdraw only $960.

Now, let’s consider the other case; when Ellena’s trade position starts going into losses. Say her trade position is already down $500. At this point, the exchange will trigger a margin call to Ellena to top up her account with more capital. If she doesn’t do so, and say her losses reach $800, then the exchange will close her trade position, take back the $4000 worth of loan, $40 worth of interest, and return the remaining $160 to Ellena. The exchange makes sure there are enough funds in the position to give the margin lenders their principal and interest. In this way, the loans are secured.

How Flint used to generate returns previously

Flint started its operations in March 2022. We used to generate returns through a mix of institutional lending and deploying funds across DeFi protocols. Our partner institutions, which include hedge funds and top exchanges, hold Bitcoin (BTC), Ethereum (ETH), and more such assets in huge quantities. From time to time, they need capital for trading, market making, etc, but they don’t sell off the assets they hold for these short-term capital needs. Instead, they prefer to pledge these assets with companies like Flint and borrow in return. These loans are mostly over-collateralized.

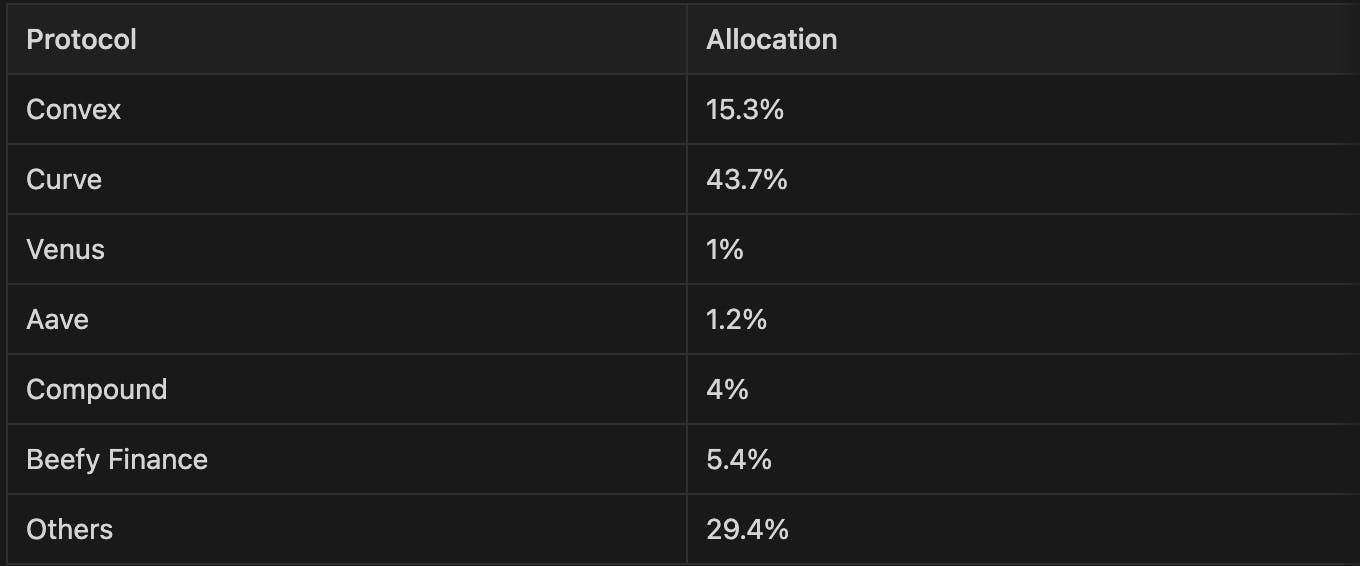

Flint thoroughly assesses each institution it partners with before lending out any funds. Apart from this, we also used to diversify a small portion of our users’ funds across various DeFi protocols with varied risk-return ratios to meet our overall risk-based diversification requirements.

Here’s how we allocated funds across DeFi protocols:

As markets move into bear cycles, the borrowing activity on DeFi protocols reduces. This means that there are many more lenders than borrowers, which results in a drop in interest rates. At the same time, as our partners trade with lesser volumes in bear markets, the loans they demand are of smaller amounts and at lower rates.

However, it is still possible to find institutions who are trading on high risk strategies, such that they need the amounts that we have to lend, but that would expose us to higher risk. And we avoid such exposure.

As the rates dropped, we had to move away and find new avenues of yield generation to sustain the high yields at as low risk as possible.

The risks involved

When engaging in margin lending, the following risks are involved:

- Credit risk: If our exchange partners go bankrupt or default on their said promises, we might not be able to recover the margin loans we have given them. To mitigate this, Flint’s risk management team vets different exchanges and only lends to those with the lowest probability of going bankrupt or defaulting.

- Liquidation failure risk: In Ellena’s example from above, if the tech solution of the exchange she uses fails to liquidate her trade position after her position reaches a loss of $800, then we will have to depend on Ellena to return the funds we had lent to her. And this may result in a case where we can’t recover the amount. However, this has almost never happened with any of the exchanges we work with.

Sustainability of the returns generated

Returns are definitely sustainable with margin lending. Margin lending is a method of yield generation that is most resistant to bear markets in terms of sustaining high yields. But there is also a downside to margin lending. It can’t support volumes beyond a few hundred million dollars at high interest rates. At Flint, we still have some time before we cross the $100M mark in crypto deposits, and hence, we find ourselves positioned very comfortably.

Why we don’t offer higher returns

One of the core tenets of Flint is that we always strive to reduce the risk we take on our users’ capital and mitigate the risk of any losses by as much as possible. Be it the world of crypto or traditional finance; investments usually follow a thumb rule:

- High risk gives high returns

- Low risk gives Low returns

- Medium risk gives medium returns

It’s theoretically impossible to mitigate risks completely, but we try to minimise them as much as possible. And doing so comes at a cost of reduced returns.

We are always stretched between the temptation to promise higher returns and further reducing the risk to levels we’d prefer. And after thoughtful consideration, we have chosen to stay on the side of reducing risks. But Flint still comes with high risk. As we progress, you can expect us to come up with more offerings across the risk spectrum. We will create a higher risk — higher returns offering than the current one, and also a lower risk — lower returns offering.

Did we have any exposure to Anchor

No. Flint did not have any exposure to Anchor. All our users’ funds were safe from the LUNA crash. In April, we were exploring if we should expose a small portion of our Assets Under Management (AUM) to Anchor, but it didn’t pass our risk checks. So we held back.

Who are our custody and security partners

We have FTX, PingSafe and AWS as our custody and security partners.

FTX is one of the top 3 crypto players globally, managing billions of dollars of funds that flow through its systems. In special association with FTX, Flint has arranged for the best-in-class custody. This means that your funds are now secured and guarded under the watch of the best engineers at FTX.

Our cloud and infra security is powerfully guided by PingSafe. It maintains a watch 24x7 and detects even the most minute vulnerabilities in time to prevent harm to our security keys and systems.

We use the most secure and reliable infrastructure provided by AWS. All of Flint’s data exchange happens through SSL using TLS 1.2 and your sensitive data is securely stored with AES-256 encryption.

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.