How to earn interest on Stablecoins?

Jump to:

What is a Stablecoin?

Stablecoins are crypto tokens whose value is pegged to another currency, commodity, or financial instrument. Stablecoins bring stability to the volatile crypto market. In recent years Stablecoins have gained an impressive amount of traction due to the utility they provide. It helps investors de-risk positions while avoiding transfers to fiat. Users can move tokens between exchanges and protocols securely, send payments and even lend out idle Stablecoins for accruing interest.

What are top Stablecoins?

There are 4 major stable coins that exist in the crypto market such as Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and DAI (DAI). U.S dollars backs the bUSDT, USDC and BUSD directly. These coins have a higher chance of maintaining their 1:1 Peg. DAI is a Stablecoin that is not collateralized by crypto assets but rather by USD but rather. DAI does not always maintain a 1:1 peg. It has fluctuated by up to 8 cents for short periods of high volatility.

How to Earn Interest on Stablecoins?

Decentralized Stablecoin borrowing and lending is becoming popular among the investors to earn passive income. Investors can lend Stablecoins and earn annual yields. Yield farming (Crypto lending on the blockchain) is one of the biggest applications of decentralized finance. Hre are many ways to earn interest on Stablecoins.

Before going in details, let us describe our crypto investment platform that gives huge returns to its users. Flint is a crypto platform with high interest rate for your crypto. It provides an efficient crypto staking service where you can stake coins including Stablecoins like USDT, USDC, and DAI. Check this link for details.

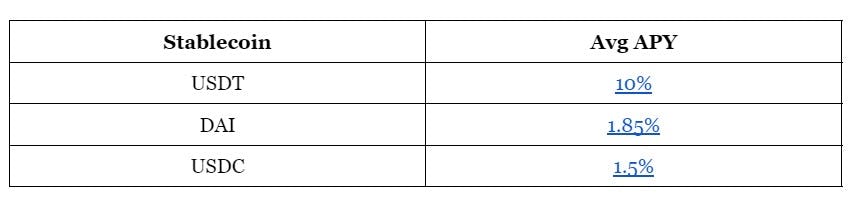

Below are the Stablecoins listed on Flint and the corresponding average interest, compounding annually that you can earn:

Yield Accrual Methods

The crypto asset space is a diverse ecosystem. Crypto traders can earn in countless ways, but the main procedures are farming and lending.

Automated Stablecoin Lending

Investors can lend their crypto assets to earn interest.You don't have to actively manage DeFi protocols, Origin Protocol's OUSD Stablecoin lets you earn interest directly from their crypto wallets. OUSD is pegged 1:1 and backed by other Stablecoins DAI, USDC, and USDT. The

Yield Farming & Liquidity Provision

Users can provide liquidity to decentralized platforms such as Uniswap, Sushiswap and Curve. These decentralized platforms have large reserves of tokens that allow liquid movements of funds through the orderbook of each individual trading pair. When a user provides liquidity, they get rewarded based on the exchange fee and volume of transactions on the specific trading pair. Users can yield farming with Stablecoins at a very little risk. It benefits traders and investors, and protects from market drawdowns. vArious platforms provide high yield on farming like Aave, MakerDao and Flint.

Are Stablecoins a good investment?

Stablecoins are a good investment because they are relatively stable and backed by the US dollar. Stablecoins tackle the volatile nature of cryptocurrencies and are not affected much by the volatility of the crypto market. Tether (USDT). It is the first Stablecoin in crypto history and its value is tied to the US dollar. The interest rates are high on Stablecoins because of simple economics. The demand for Stablecoins exceeds their supply and users holding Stablecoins lend their coins and charge a premium interest rate. Crypto platforms offer high-interest rates on Stablecoins to attract new Stablecoin lenders.

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.