Top 4 Crypto Lending Platforms to borrow against your coins

Jump to:

Disclaimer: Flint does not endorse any of the platforms mentioned in this article in any capacity. Readers are advised to research into the risk aspects of these platforms before making any investment.

What is crypto lending and how does it work?

In the world of traditional finance, the concept of lending is as old as the time when civilizations started. A person who needs to borrow money needs to approach an institution called the bank. Lending, in any system, serves a dual purpose of fulfilling the requirements of both the borrower who wants money to fulfill their requirements and the lender who wants to earn an extra amount on their holdings.

Similarly, the concept of lending has been adopted in the world of web3 through the system called decentralized finance (Defi). Any cryptocurrency holder can deposit their crypto assets with the lending platforms and earn interest on them. Similarly, a borrower can borrow the crypto assets for a fee on the loan. The borrowed money is used for hedging, speculation, etc.

The difference between the fee received from the borrower and the interest paid to the lender is the amount earned by the lending platforms. Crypto lending services are available in both centralized and decentralized platforms.

How does crypto lending work?

There are 3 parties involved in crypto lending:

- The lender

- The borrower

- The platform

This is how the lending process works:

- The borrower, as per their needs, approaches the crypto lending platform and put forth the request for a loan. They would have to stake some crypto as collateral in order to get a loan.

- On the other hand, lenders who want to earn interest on the platform would deposit their crypto assets with the platform.

- The platform would lend out the loan, as required, by the borrower and would pay out the interest to the lender.

- The borrower would get back the collateral crypto only when they pay back the entire loan amount.

What is an over-collateralized loan?

As crypto assets are one of the most volatile assets in the market, to obtain a loan, a user has to deposit more cryptocurrency than its actual loan value. And hence, this is called over-collateralization i.e more collateral has to be offered than the actual loan amount.

What are flash loans?

Flash loans are the loans that are transacted and repaid in the same transaction. Flash loans are based on smart contracts. The first step in flash loans is receiving the loan, the second is using the loan for a productive purpose, and then finally paying back the loan in a rapid process. They are mainly used for arbitrage opportunities, collateral swaps, etc.

Top 4 crypto lending platforms

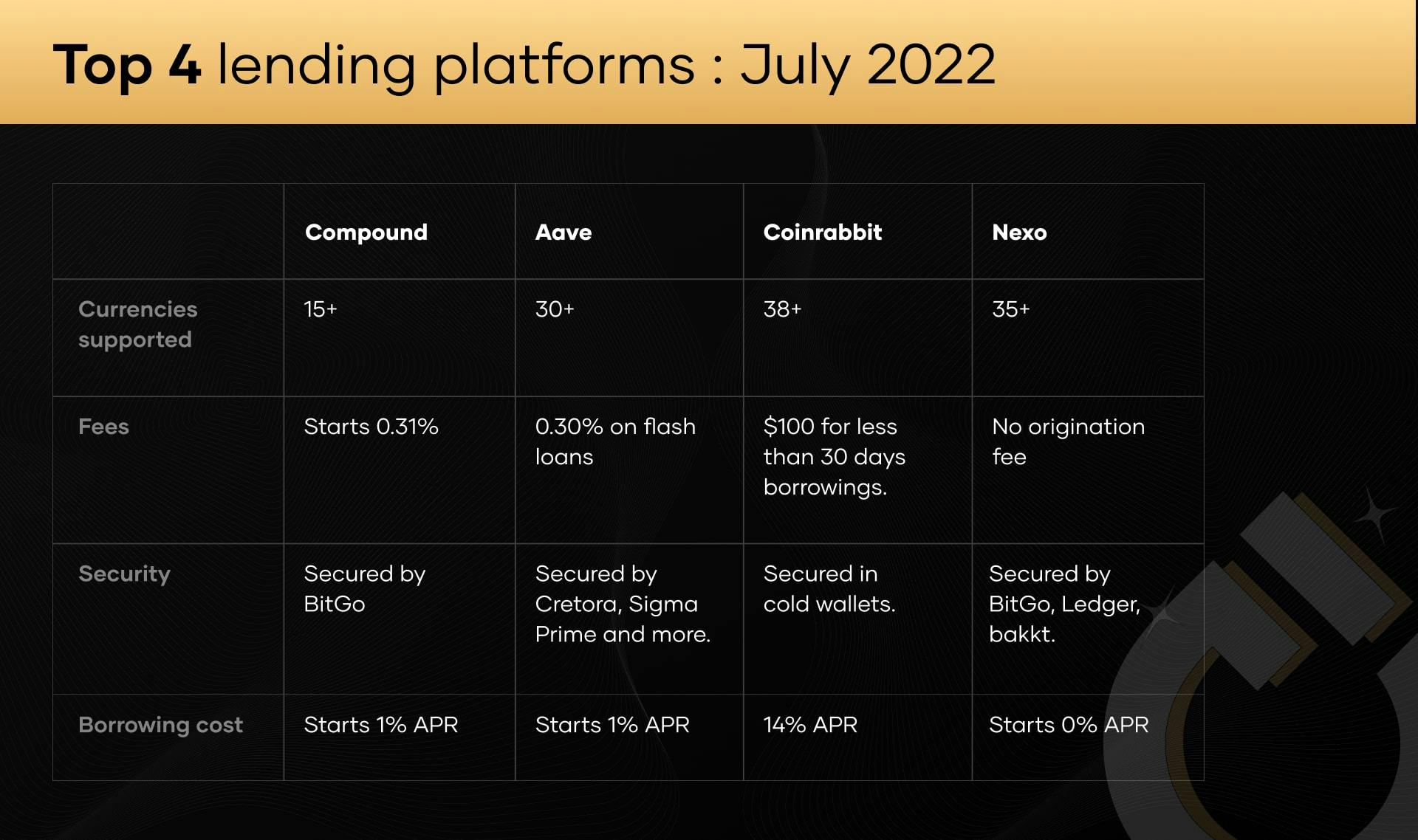

Here are the top 4 crypto lending platforms in July 2022

Compound

In the world of decentralized finance, Compound is one of the known names for lending and borrowing. As a platform, it allows users to borrow 15+ tokens starting at 1% APR. The platform is highly secured and backed by BitGo.

Aave

Aave is one the most famous and trusted decentralized lending platforms which also allows users to stake their crypto assets and get loans against the collateral. Users deposit their assets into a liquidity pool and in turn the protocol lends out the same. Aave is built over the Ethereum blockchain and utilizes ERC-20 tokens. As an upgrade, Aave can be assessed over other blockchain platforms as well such as Solana, etc. One can borrow loans and flash loans starting at 1% APR and can choose from 30+ supported tokens on the platform.

CoinRabbit

CoinRabbit is one the leading and fastest crypto loan provider solution available in the market. The platform supports lending against 38+ tokens and users borrow the funds at 14% borrowing rate. The platform is secured via cold wallets and storages.

Nexo

Nexo is one of the world-leading lending companies in the decentralized world. Nexo allow users to borrow funds starting at 0% APR. Funds at Nexo are secured at leading crypto custody solutions such as BitGo. The platform supports all the leading token and hosts a total of 35+ token on its platform.

Here is an infographic comparing the top crypto lending platforms for July 2022

If you haven't already, you should read our article on top players in crypto staking to understand a very important aspect of DeFi

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.