What is DeFi?

Jump to:

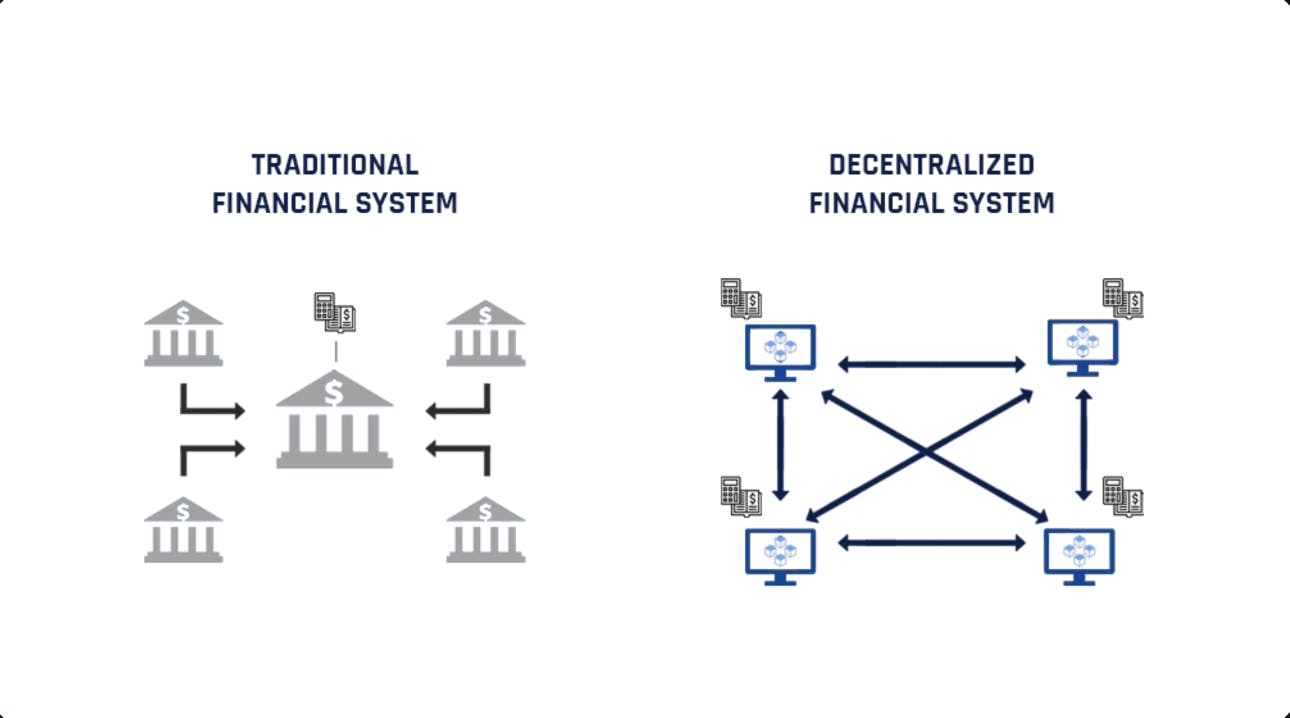

DeFi (decentralized finance) is the crypto version of the finance industry.

It refers to financial services like depositing, withdrawing, lending, borrowing money, and many more with the help of smart contracts (a program that runs when certain conditions are met) instead of trusting financial institutions such as banks or exchanges like the NASDAQ.

DeFi comes with all the crypto features because its underlying technology is public blockchains like Ethereum and Solana. If you haven’t already, read our article on What is Solana?

It is:

- Global: Can be accessed by anyone sitting in the world.

- Peer-to-peer: Directly between two people.

- Pseudoanonynous: Can be accessed without revealing any information about the user.

- Transparent: Everyone can see the transactions on the public blockchain.

Capabilities of DeFi

DeFi has a lot of advantages over CeFi (centralised finance) like:

- Trust

- Open to all

- Ownership and returns

- Transparent

- Flexible and fast

Source: Odyssey DAO

Trust

- DeFi: Trusts code.

- CeFi: Relies on middlemen.

In CeFi (centralized finance), you need to rely on a bank to send money, earn interest, and get a loan.

For example, there was a breach of trust when loans without proper checks were issued to famous industrialists like Nirav Modi, leading to a loss of about ₹11,356.84 crores. It would not have been issued in DeFi because it relies on code, which means every transaction is public and will not be completed if proper checks in the smart contract are not met.

Open to all

- CeFi: You need to apply for opening a bank account with your ID.

- DeFi: You can access it by creating a wallet.

For example, in CeFi (centralized finance), you need to apply for opening an account in the bank before using any bank’s financial services. But in DeFi, you don’t need anything to create your wallet to access any service of a DeFi app.

Ownership and returns

- CeFi: Banks or the middlemen own and control your money. It provides low returns because middlemen take out a significant cut from the transactions.

- DeFi: You own and control your money. It provides high returns because there is no involvement of middlemen who take the cut.

Transparent

- CeFi: You are blind to the internal operations of banks.

- DeFi: Multiple DeFi protocols are open source (public code on the internet), and everyone involved can see all of the transactions.

For example, in CeFi (centralized finance), you don’t know what the bank does with your money. But in DeFi, the process your money goes through is public because the code is public on the internet.

Flexible and fast

- CeFi: Opens only during business hours, asks for lots of privacy permissions and long transfer time.

- DeFi: Works 24/7, no permissions required, fast, cheap, and works across the globe.

For example, suppose an individual wants to transfer money from anywhere in India to Europe at any time. In that case, there is no way in centralized finance to execute this transaction instantaneously with minimal cost. Still, using DeFi, this transaction can be performed instantaneously at a low cost at any time of the day.

How does it work?

dApps(decentralized apps) are used to access DeFi. Anyone with a wallet can engage with these dApps, so no need to “open” an account with any centralized authority.

Users generally use DeFi applications for

- Lending: You can lend your crypto to earn interest in short intervals of time, like per minute/hour and not per month/year. The rates vary between 5% to 200%, and these can be compounded automatically to give even higher returns.

- Trading: You can make peer-to-peer trades. It is similar to buying/selling stocks without any brokerage fee.

- Borrowing: You can get instant loans without paperwork while submitting your crypto as collateral. It also provides the facility of flash loans which means you can get loans of millions of dollars for a very short period using protocols like AAVE.

- Savings: Put some of your cryptos into savings account alternatives like Flint and earn better interest rates on fiat currency than you’d typically get from a bank.

- Buying derivatives: These are crypto versions of stock options and futures contracts. You can make short-term and long-term bets.

Conclusion

The DeFi scene is bursting with innovation and investment that can change the landscape of current financial systems.

With many rug pulls, high complexity for users, and an unpleasant user experience, it isn’t easy to navigate through DeFi for beginners. To ease everything, Flint provides returns up to 10% p.a. with controlled risk and no lock-in period.

DeFi will continue to grow just as India grows, and Flint will continue to offer its services as DeFi expands further. If you haven’t already, learn How Flint generates 10% returns?

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.