What is Kine Protocol?

Jump to:

Kine Protocol is a multi-chain decentralized exchange. The platform supports on-chain staking, has no gas fees, and has decreased slippage for trading derivatives. The peer-to-pool approach offers traders a market with no restrictions on underlying or liquidity. By utilizing an off-chain execution engine and an on-chain staking system, Kine guarantees the lowest trading costs while also providing users with a safer trading environment. The site asserts that each trade is carried out in real-time.

What is kUSD

Users with unused debt limits can mint kUSD, a digital currency that mimics the USD and is backed by a liquidity pool. Kine Exchange, a peer-to-pool derivatives trading platform that offers multi-asset exposure with zero-slippage trading experience, only accepts the currency kUSD.

The KINE token is a utility token created to simplify community governance and encourage the Kine Ecosystem's beneficial cycle.

When Kine reaches maturity, community governance will progressively take over, allowing the community to determine the protocol's course. Holders of KINE tokens may use them to vote or submit suggestions to enhance the Kine Protocol.

Kine Exchange will disperse the trading commissions and funding it has received to the participants in the liquidity pool. Through a third-party DEX like Uniswap, the exchange will accumulate revenues in kUSD and convert them into KINE tokens.

Stakers can reclaim their benefits from the distribution contract on a regular basis.

How to Get Started With Kine Protocol?

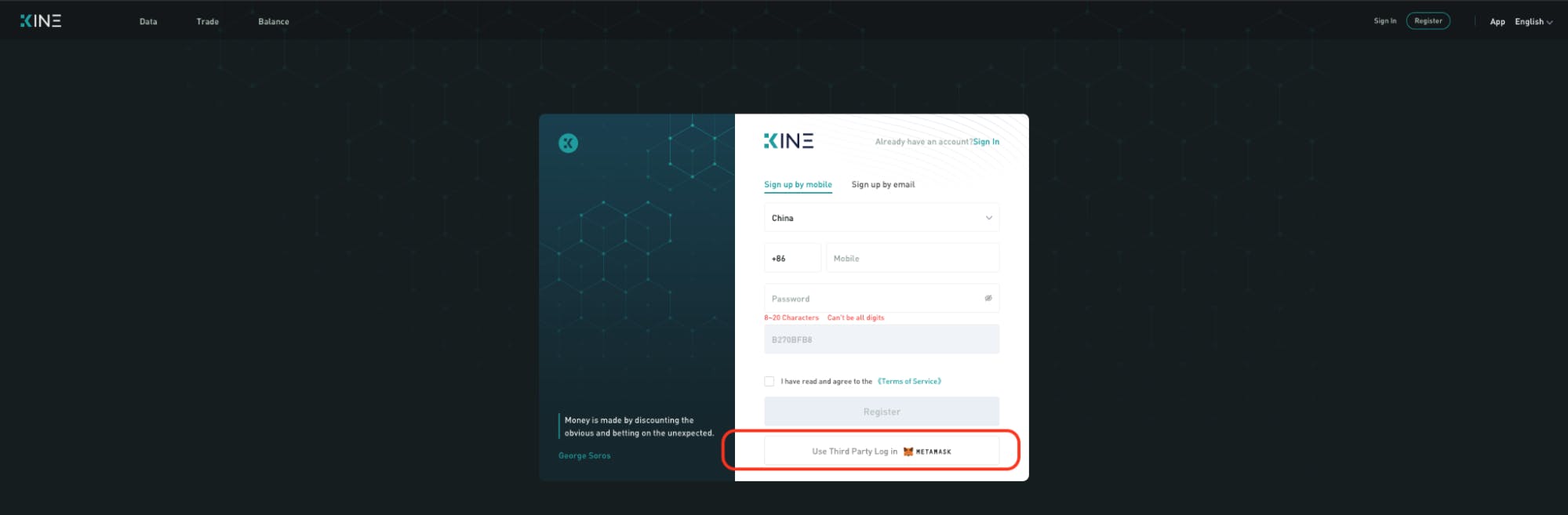

Step 1: Sign up for Kine exchange and make a deposit

Users of Metamask can connect instantly without registering. You will be prompted to sign a message (using no gas) after selecting "Connect with Metamask," and after a few delays, you will be logged onto Kine exchange

Your assets are displayed in each trading platform account under the "Balance" tab. To get your deposit address, click "Deposit." Similar to most cryptocurrency exchanges, you can send your kUSD to the provided address. Your token balance will be updated upon the confirmation of 12 blocks.

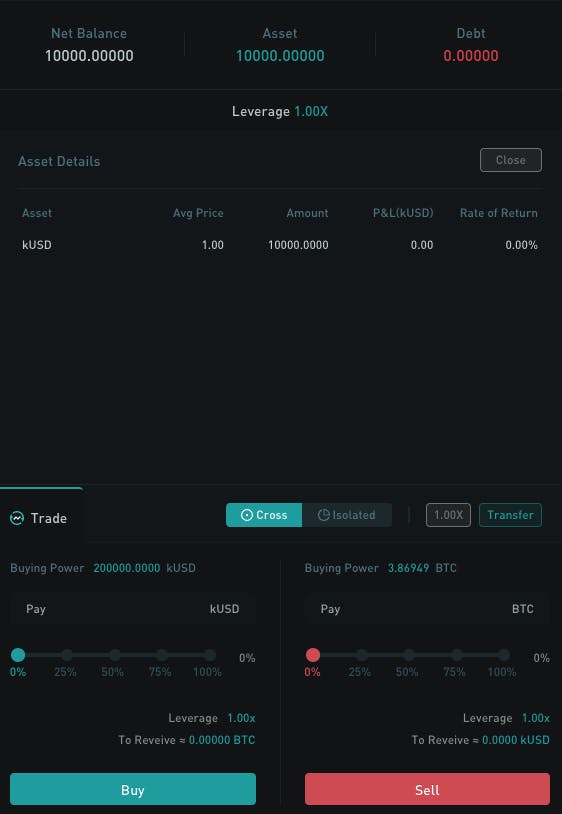

Step 2: Transfer kUSD to the Cross Margin account to begin trading. In the top-left section, you can choose an asset and view its price movement and funding rates. Examine the account's equity, assets, debt, and leverage liquidation price (only for isolated assets) before placing an order:

Competitors of Kine Protocol

A platform similar to Kine Protocol maybe Spring Rolls, which is a new generation DeFi project that combines a decentralized cryptocurrency exchange, an automatic market maker protocol (AMM), a yield farming platform, and even an NFT marketplace. Thus, Spring Rolls users have a wide variety of options to generate revenue.

Conclusion

A customizable portfolio of digital assets serves as the foundation for the general purpose liquidity pools created by the decentralized protocol known as Kine. Without the requirement for counterparties, the liquidity pool enables traders to open and close derivatives positions in accordance with reliable price feeds. By permitting third-party liquidation and extending the collateral space to include any Ethereum-based assets, Kine removes the barrier to entry for existing peer-to-pool (also known as peer-to-contract) trading protocols.

Like this article? Spread the word

Subscribe to our

newsletter!

Receive timely updates on new posts & articles about crypto world.